Offshore Trust Services: Structure a Solid Financial Structure

Establishing Sail for Financial Freedom: Exploring Offshore Trust Fund Providers as an Entrance to International Wealth Monitoring

Look no further than overseas count on solutions as your gateway to worldwide wide range management. In this post, we will certainly guide you with the ins and outs of recognizing overseas trust services, the benefits they use in terms of property protection, just how to choose the best offshore territory, and crucial factors to consider for building your own count on.

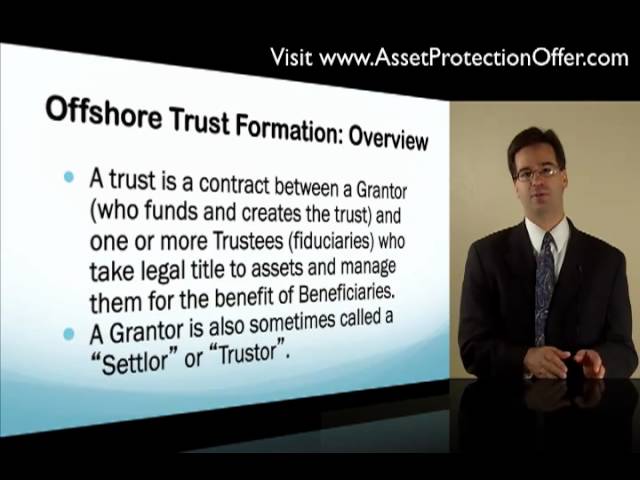

Understanding Offshore Trust Providers: A Trick to Worldwide Wealth Management

Recognizing overseas count on services is important for those seeking to take part in worldwide wealth management - offshore trust services. Offshore trusts are an effective device that allows people to secure and grow their assets in a personal and tax-efficient way. By placing your properties in an overseas count on, you can profit from lawful and monetary advantages that are not offered in your home nation

Among the main advantages of overseas trust fund solutions is the ability to minimize tax obligation obligations. Offshore jurisdictions often have more desirable tax obligation legislations, enabling you to legally decrease your tax obligation problem. This can cause significant savings and raised riches accumulation with time.

One more advantage of overseas trusts is the degree of asset defense they supply. By placing your properties in a jurisdiction with solid asset defense laws, you can guard your riches from potential lenders, lawsuits, or other economic threats. This can give you satisfaction knowing that your hard-earned cash is safe.

Furthermore, offshore trust fund services use a high level of privacy and privacy. Offshore jurisdictions prioritize client privacy, ensuring that your monetary events remain private. This can be specifically advantageous for individuals who value their privacy or have concerns concerning the safety and security of their possessions.

Benefits of Offshore Depend On Services in International Possession Protection

Optimize your property protection with the advantages of offshore trust fund services in safeguarding your worldwide riches. By developing an offshore trust, you can successfully protect your properties from legal cases and potential threats. One of the essential advantages of overseas trust fund solutions is the improved level of confidentiality they offer. Unlike conventional onshore depends on, offshore trusts supply a higher level of privacy, ensuring that your economic events stay discreet and shielded from spying eyes.

Another substantial benefit of overseas count on solutions is the versatility they offer in regards to wealth monitoring. With an overseas trust, you have the capacity to diversify your assets throughout different territories, enabling you to capitalize on beneficial tax obligation programs and financial investment chances. This can cause considerable tax obligation cost savings and raised returns on your investments.

In addition, offshore trust fund services supply a greater level of possession protection compared to residential trusts. In the event of a lawful dispute or monetary situation, your offshore count on can serve as a shield, guarding your assets from prospective financial institutions. This added layer of security can supply you with comfort and ensure the longevity of your riches.

Exploring Offshore Jurisdictions: Choosing the Right Location for Your Trust Fund

When choosing the best overseas territory for your trust fund, it's vital to consider elements such as tax advantages and legal framework. Offshore jurisdictions provide a variety of advantages that can assist secure your properties and maximize your economic monitoring. By meticulously taking into consideration these factors, you can pick the right overseas territory for your trust fund and get started on a trip in the direction of monetary flexibility and worldwide riches management.

Structure Your Offshore Depend On: Secret Considerations and Strategies

Choosing the appropriate territory is vital when developing your offshore trust, as it determines the degree of lawful security and stability for your assets. Constructing an offshore count on requires mindful factor to consider and calculated planning. Most importantly, you need to determine your goals and goals for the count on. Are you aiming to shield your properties from prospective lawsuits or creditors? Or probably you intend to reduce your tax liabilities? It is vital to research and examine different jurisdictions that straighten with your needs when you have actually defined your goals. Seek jurisdictions with strong lawful structures, political stability, and a positive tax obligation environment. Furthermore, take into consideration the credibility and track document of the territory in dealing with overseas trust funds. Inquire from specialists that specialize in offshore depend on solutions, such as legal representatives or wealth managers, that can lead you through the process and assist you browse the intricacies of overseas territories. Each jurisdiction has its very own collection of policies and policies, so it is crucial to have a peek at this site recognize the lawful and financial implications before making a decision. By taking the time to carefully choose the ideal territory, you can make certain that your overseas trust fund provides the level of protection and stability you desire for your assets.

Making Best Use Of Returns: Investing Techniques for Offshore Counts On

Purchasing a diverse portfolio can assist offshore trusts attain higher returns. When it involves handling your overseas count on, among the most vital aspects to take into consideration is how to maximize your returns. offshore trust services. By expanding your investments, you can alleviate danger and enhance the potential for greater gains

Most importantly, it is essential to comprehend the idea of diversification. This technique includes spreading your investments across various asset courses, markets, and geographical regions. By doing so, you are not placing all your eggs in one basket, which can aid protect your portfolio from prospective losses.

When picking investments for your you could try here overseas depend on, it's vital to take into consideration a mix of properties, such as stocks, bonds, actual estate, and assets. Each possession course has its very own danger and return features, so by buying a variety of them, you can possibly take advantage of different market problems.

In addition, staying educated regarding market patterns and financial signs is essential. By remaining updated with the most recent news and events, you can make educated financial investment choices and readjust your profile appropriately.

Conclusion

So currently you understand the advantages of overseas count on solutions as an entrance to international wide range administration. By understanding the crucial considerations and techniques included in navigate to this site developing your offshore depend on, you can maximize your returns and safeguard your properties.

In this post, we will guide you with the ins and outs of comprehending overseas depend on solutions, the benefits they use in terms of asset defense, exactly how to select the right offshore territory, and essential considerations for building your very own trust fund. Unlike typical onshore depends on, offshore depends on provide a higher level of personal privacy, making sure that your monetary events stay discreet and safeguarded from spying eyes.

In addition, offshore depend on services supply a higher degree of asset defense compared to domestic trust funds.Selecting the ideal territory is critical when building your overseas depend on, as it identifies the degree of lawful security and stability for your assets. Look for advice from experts that specialize in overseas trust fund solutions, such as attorneys or wealth supervisors, that can lead you through the procedure and help you navigate the intricacies of overseas territories.